wonder-digital.ru

Tools

Best Home Insurance Companies In Nj

Best condo insurance companies in New Jersey ; State Farm, $, A++, ; Allstate, $, A+, Insurance for the way you live. For over years, Franklin Mutual Insurance (FMI) has provided property and casualty insurance for NJ residents and. NJM's customer service has been recognized both regionally and nationally as among the best. Here are six reasons why NJM offers the best homeowners insurance. Best of Both Worlds Over 9, homeowners in the Mid-Atlantic region turn to Heist Insurance Agency to handle the intricacies of coastal home and flood. Compare The Best Condo Insurance Companies In New Jersey ; Nationwide. Overall ; Travelers. Discounts ; Chubb. High-Value Condos ; Amica. Runner. Best and Cheapest Homeowners Insurance Company in NJ-NY-PA. Get an insurance quote from an expert Insurance Broker Today. We do the work for you. Selective Insurance: Best home insurance in New Jersey. · Progressive: Excellent for affordable home insurance. · State Farm: Best for home and auto bundling. Best Homeowners Insurance Agencies in Toms River, NJ · Our Recommended Top 6 · Providers · All Atlantic Insurance Agency · Capstone Insurance · Colonial Insurance. SelectQuote partners with some of the most trusted home and auto insurance companies in New Jersey. We compare rates from these carriers to provide you with. Best condo insurance companies in New Jersey ; State Farm, $, A++, ; Allstate, $, A+, Insurance for the way you live. For over years, Franklin Mutual Insurance (FMI) has provided property and casualty insurance for NJ residents and. NJM's customer service has been recognized both regionally and nationally as among the best. Here are six reasons why NJM offers the best homeowners insurance. Best of Both Worlds Over 9, homeowners in the Mid-Atlantic region turn to Heist Insurance Agency to handle the intricacies of coastal home and flood. Compare The Best Condo Insurance Companies In New Jersey ; Nationwide. Overall ; Travelers. Discounts ; Chubb. High-Value Condos ; Amica. Runner. Best and Cheapest Homeowners Insurance Company in NJ-NY-PA. Get an insurance quote from an expert Insurance Broker Today. We do the work for you. Selective Insurance: Best home insurance in New Jersey. · Progressive: Excellent for affordable home insurance. · State Farm: Best for home and auto bundling. Best Homeowners Insurance Agencies in Toms River, NJ · Our Recommended Top 6 · Providers · All Atlantic Insurance Agency · Capstone Insurance · Colonial Insurance. SelectQuote partners with some of the most trusted home and auto insurance companies in New Jersey. We compare rates from these carriers to provide you with.

We work with the highest-caliber insurers in the industry, including PURE, Chubb, AIG, Cincinnati Insurance, NatGen Premier, and Vault Custom to provide you. No two homes are exactly alike. The same is true of home insurers. At Goosehead, we've reviewed scores of insurance companies and evaluated the coverage. Your search matched the companies displayed below. Please be aware that an insurance company may have different subsidiaries with different names. Every insurance company calculates costs in a different way, so shopping around can save you hundreds of dollars. Independent agents make comparison shopping. The best homeowners insurance in New Jersey is offered by Selective Insurance. Progressive and State Farm also top our rating for the best home insurance. Horizon BCBSNJ offers affordable New Jersey healthcare and health insurance for individuals, families and employers. Find cheap NJ health insurance quotes. State Farm, New Jersey Manufacturers (NJM), Allstate, Travelers, and Liberty Mutual are the largest home insurance companies in New Jersey. These are also. NJM Homeowners Insurance is available to all New Jersey and Pennsylvania residents Coverage provided and underwritten by NJM Insurance Company and its. Your home is unique. That's why at Liberty Mutual, you can customize your coverages to get the best homeowners insurance for your home at an affordable. In NJ, NJM and USAA are the only two companies that offer decent value for service. If you're eligible for USAA take a look and compare. If not, I think NJM is. We can provide you with up to 10 New Jersey homeowners insurance quotes from leading insurers. We'll also help you understand your options. Shopping for homeowners insurance quotes in NJ is easier than ever with Progressive's Home Quote Explorer®. Use it to compare rates and coverages from multiple. Umbrella liability coverage for a pool or other high-risk items. We work with the top home insurance companies to get you affordable homeowners insurance rates. State Farm, Stillwater, American Family, Farmers, and Nationwide offer top-notch insurance. Learn why they're the best home insurance companies for many. Understand the way homeowner's insurance works; Identify the kind of policy and coverage you really need; Compare policies from different companies to find the. Best and Cheapest Homeowners Insurance Company in NJ-NY-PA. Get an insurance quote from an expert Insurance Broker Today. We do the work for you. Amica was awarded “Highest Customer Satisfaction Among National Homeowner Insurers, 17 Years in a Row.”4. See How We're Recognized. This product is. We help customers realize their hopes and dreams by providing the best © Allstate Insurance Company. ¹Features are optional and a part of the. Top 19 home insurance companies in New Jersey · 1. NJM Insurance Group · 2. Tokio Marine America · 3. SageSure · 4. Coaction Global · 5. All Point Insurance Agency.

United Concordia Dental Retired Military

We're proud to serve those who serve the nation, from active duty military personnel and their families worldwide, to federal employees and military retirees. administered by United Concordia wonder-digital.ru TRICARE Dental Program must receive all dental care at that Military Treatment Facility. Service. The TRICARE Active Duty Dental Program (ADDP) works with United Concordia in-network dentists to provide dental care to active duty service members. Active-duty members receive their dental care through the military, managed by United Concordia. Retiree Dental Program. In addition to those entitled. They're decent but you have to be a Fed employee or military retiree to apply for coverage. United Concordia. Dental cleaning every months. To the best of United Concordia Dental's knowledge, any letter(s) issued by military dental treatment facility (DTF). The ADDP provides authorized. Enroll Now. Click below to enroll for TDP Dental Coverage Online through milConnect. Enroll Now at milConnect ; Log In. Click here to access your TRICARE online. Note: Former spouses of TRICARE- eligible individuals may enroll in a FEDVIP vision plan. • FEHB Temporary Continuation of Coverage (TCC) enrollees. • Anyone. Eligible federal employees, annuitants and military retirees can enroll in FEDVIP. Coverage would be effective the first day of the first pay period. We're proud to serve those who serve the nation, from active duty military personnel and their families worldwide, to federal employees and military retirees. administered by United Concordia wonder-digital.ru TRICARE Dental Program must receive all dental care at that Military Treatment Facility. Service. The TRICARE Active Duty Dental Program (ADDP) works with United Concordia in-network dentists to provide dental care to active duty service members. Active-duty members receive their dental care through the military, managed by United Concordia. Retiree Dental Program. In addition to those entitled. They're decent but you have to be a Fed employee or military retiree to apply for coverage. United Concordia. Dental cleaning every months. To the best of United Concordia Dental's knowledge, any letter(s) issued by military dental treatment facility (DTF). The ADDP provides authorized. Enroll Now. Click below to enroll for TDP Dental Coverage Online through milConnect. Enroll Now at milConnect ; Log In. Click here to access your TRICARE online. Note: Former spouses of TRICARE- eligible individuals may enroll in a FEDVIP vision plan. • FEHB Temporary Continuation of Coverage (TCC) enrollees. • Anyone. Eligible federal employees, annuitants and military retirees can enroll in FEDVIP. Coverage would be effective the first day of the first pay period.

Dental Program (ADDP) contract, administered by United Concordia Companies, Inc. dental care at overseas military dental clinics. TRICARE Dental. JOIN THE MISSION. TO PROTECT MILITARY SMILES. How to enroll now. United Concordia Companies, Inc. (UCCI) of Harrisburg, Pennsylvania, protests the award of a contract by the Department of Defense, TRICARE Management. TRICARE currently offers two dental programs to meet the needs of its beneficiary population: TRICARE Dental Program; TRICARE Retiree Dental Program (TRDP). We're proud to be a FEDVIP carrier offering Standard and High Option plans to eligible federal employees, federal retirees, and military retirees. View all the great benefits you receive through United Concordia Dental with Tricare for Active Duty members. RETIRED MILITARY & CURRENT GOVERNMENT / CIVIL. military dependents and have dental insurance through United Concordia (UCCI). Weaver is a retired Army officer with over 20 years of service and is a. United Concordia Dental℠ is a nationwide dental company with more than 50 years of experience, offering a commitment to oral health, a large national. For more information, visit the United Concordia “Clients' Corner” page. Retired military (20+ years of service, under age 65) or a family member. (DoD) program managed by United Concordia Companies, Inc. DFAS will provide IRS Form C to all U.S. military members, and IRS Form B to all retirees. You get active duty dental benefits if you're on active duty orders for more than 30 days or covered by TAMP. >>View TRICARE Dental Program Costs. Dental. Have questions about your TRICARE insurance with United Concordia? Give us a call at , and we'd be happy to assist. United Concordia TRICARE Dental Program. P.O. Box Pittsburgh, PA • Retired service members and their eligible family members. • Retired. The TRICARE dental program is offered through United Concordia. Family retired uniformed service members and active duty family members. Additional. This Certificate of Insurance provides information about Your dental coverage. Read it carefully and keep it in a safe place with Your other valuable documents. Summary of Benefits. A Nationwide Dental PPO Plan. Who may enroll in this plan: All Federal employees, annuitants, and certain TRICARE beneficiaries in. Delta Dental's Federal Employees Dental Program; GEHA® Connection Dental Federal; The MetLife® Federal Dental Plan; United Concordia® Dental; UnitedHealthcare®. The ******* Dental Program (*DP) offered by the Department of Defense (DoD) through the Defense Health Agency (DHA), provides worldwide dental coverage to. Retired Military - CDCA1 Metlife - Regular Metlife coverage - United Concordia - Regular United Concordia coverage - CX Specific to PO Box If United Concordia is unable to obtain the requested premium payment from the member's military payroll account for any reason, the member will be responsible.

How To Get A Non Refundable Deposit Back

return of non-refundable deposits get back at the end of your lease term if you meet certain requirements. You'll see that the deposit is non-refundable." Sleep on it. Don't ever make decisions at the height of emotion or under stress. Talk to a lawyer and put. You can dispute a deposit at the bank when the sum deposited by bank towards interest due to you is less than what was agreed to. Non-refundable means you don't get your money back once you make the deposit. is not a valid auction number, can't find it, and the car is 12 yrs. Work with a professional who drafts contracts. You can create provisions that allow for you to keep your deposits in certain circumstances, but be able to. If you did not actually rent the property or item, this money will also be entirely refunded. The other kind of deposit is a payment that is made, usually as. A non-refundable deposit is likely to be refundable when the photographer breaches or terminates the contract. Like other said, there isn't a "best way" to ask other than being assertive but non-demanding. Since your contracts probably state that the deposit is non-. Contact one of the attorneys at McNamee Hosea if you need assistance with establishing a non-refundable deposit clause for your business. return of non-refundable deposits get back at the end of your lease term if you meet certain requirements. You'll see that the deposit is non-refundable." Sleep on it. Don't ever make decisions at the height of emotion or under stress. Talk to a lawyer and put. You can dispute a deposit at the bank when the sum deposited by bank towards interest due to you is less than what was agreed to. Non-refundable means you don't get your money back once you make the deposit. is not a valid auction number, can't find it, and the car is 12 yrs. Work with a professional who drafts contracts. You can create provisions that allow for you to keep your deposits in certain circumstances, but be able to. If you did not actually rent the property or item, this money will also be entirely refunded. The other kind of deposit is a payment that is made, usually as. A non-refundable deposit is likely to be refundable when the photographer breaches or terminates the contract. Like other said, there isn't a "best way" to ask other than being assertive but non-demanding. Since your contracts probably state that the deposit is non-. Contact one of the attorneys at McNamee Hosea if you need assistance with establishing a non-refundable deposit clause for your business.

The non-refundable deposit shall be applicable towards the Purchase Price. If this transaction fails to close for any reason other than default by Seller, the. Should buyer get the non-refundable deposit back? A well-built, non-refundable deposit clause is hard to draft. I advise that you do not engage in the. Most suppliers relied on a “non-refundable deposit” clause to retain the customer`s deposit summarily upon prior cancellation. The issue of a “. Most suppliers relied on a “non-refundable deposit” clause to retain the customer`s deposit summarily upon prior cancellation. The issue of a “. Can I Get a Non-Refundable Deposit Back? No, a non-refundable deposit cannot be returned to the tenant under normal circumstances. It is paid to secure the. Talk to the seller. If they don't want to refund your deposit then you may have to talk to a lawyer. Sometimes just a letter from a lawyer will. Situation Refund informationIf you are a limited enrolment student in your first semesterthe tuition fee deposit is non-refundable and non-transferable. It's becoming a common provision in contracts that any payments you make upfront are "non-refundable", but does that mean you can't get any money back? Select fare programs require the payment at the time of booking of a nonrefundable deposit. That deposit amount shall not be refunded at any time after it. The buyer will only receive their deposit back after the Contract becomes unconditional if the seller defaults. Ultimately the standard terms of a REIQ Contract. Unlike a standard security deposit, the payment of the last month's rent will not be given back to the tenant, but rather used to pay rent on the last month of. If you cancel a booking, for example for a holiday or a hotel room, you may lose some money if you've paid a non-refundable deposit. Your only hope to get back some or all of your deposit is to be nice and talk it out with the seller. Misdescribed car is just about every car. Alot of people. (c) Fail to refund any purchase money, including purchase deposits, upon get in legal arguments with people they don't know, just for the sake of. This is a Non-Refundable Deposit. Please call the Salon and confirm your Non-Refundable Deposit. Back to catalog. $ In stock. Add More. Add to Bag. way to get their money back if they decide not to use or cancel their order Non-refundable deposit agreements include the deposit amount, whether the non-. I initially asked for money back less than 24 hours after deposit was made. Ideas of how to get out of this with the least loss? return of non-refundable deposits get back at the end of your lease term if you meet certain requirements. If you did not actually rent the property or item, this money will also be entirely refunded. The other kind of deposit is a payment that is made, usually as. You are probably also wondering whether you can get back, or perhaps keep, a "non-refundable deposit" paid for an event. The answer, naturally, is that it.

Barclays Corporate Bond Index

The Bloomberg Barclays MSCI Green Bond Index offers investors an objective and robust measure of the global market for fixed income securities issued to fund. ESG Ratings are available for corporate, sovereign, and government-related issuers. The minimum threshold applied to Bloomberg Barclays fixed income indexes is. Compare performance, returns, and yields for sovereign and corporate bonds around the world. Get updated data for Bloomberg Barclays Indices. The Bloomberg Barclays US Aggregate Bond Index (ticker: LBUSTRUU), formerly known as the Lehman Aggregate Bond Index and the Barclays US Aggregate Index. Tracking Bond Benchmarks. Thursday, September 05, Closing index values, return on investment U.S. Corporate Debt S&P Dow Jones Indices. U.S. Corporate. What is the Barclays Capital Aggregate Bond Index? This index is commonly used to track the performance of bond funds in the US. It tracks a wide range of. The Barclays U.S. Aggregate Bond Index (the “Index”) is a broad measure of the U.S. investment-grade fixed-income securities market. MetLife Investment Advisors. The Bloomberg Aggregate Bond Index, or "the Agg," is a broad-based fixed-income index used by bond traders and managers of mutual funds and exchange-traded. The objective of the Fund is to track the performance of the U.S. dollar-denominated corporate bond market for investment grade (high quality), fixed-rate. The Bloomberg Barclays MSCI Green Bond Index offers investors an objective and robust measure of the global market for fixed income securities issued to fund. ESG Ratings are available for corporate, sovereign, and government-related issuers. The minimum threshold applied to Bloomberg Barclays fixed income indexes is. Compare performance, returns, and yields for sovereign and corporate bonds around the world. Get updated data for Bloomberg Barclays Indices. The Bloomberg Barclays US Aggregate Bond Index (ticker: LBUSTRUU), formerly known as the Lehman Aggregate Bond Index and the Barclays US Aggregate Index. Tracking Bond Benchmarks. Thursday, September 05, Closing index values, return on investment U.S. Corporate Debt S&P Dow Jones Indices. U.S. Corporate. What is the Barclays Capital Aggregate Bond Index? This index is commonly used to track the performance of bond funds in the US. It tracks a wide range of. The Barclays U.S. Aggregate Bond Index (the “Index”) is a broad measure of the U.S. investment-grade fixed-income securities market. MetLife Investment Advisors. The Bloomberg Aggregate Bond Index, or "the Agg," is a broad-based fixed-income index used by bond traders and managers of mutual funds and exchange-traded. The objective of the Fund is to track the performance of the U.S. dollar-denominated corporate bond market for investment grade (high quality), fixed-rate.

The Bloomberg Sterling Corporate Bond Index contains fixed-rate, investment-grade Sterling-denominated bonds. Inclusion is based on the currency of the issue. What is a Barclays U.S. Aggregate Bond Index? An unmanaged market value-weighted index of investment grade, fixed-rate debt issues (including government. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index. Corporate Bond Index is designed to represent the performance of a held Invesco, Barclays/FactSet. Research Systems Inc. MAC Global Solar. The Index consists primarily of publicly issued U.S. corporate securities. The index includes both corporate and non-corporate sectors. The Bloomberg Corporate High Yield 2% Issuer Capped Index measures the USD-denominated, high-yield, fixed-rate corporate bond market and limits each issuer to 2. The Bloomberg U.S. Corporate High Yield Bond Index measures the. USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as. Benchmark Indices (as of September 6, at PM) ; Bloomberg Barclays Euro Contingent Capital Bond TR Index Unhedged EUR. BLXCTREU, EUR, Unhedged. The Bloomberg Barclays U.S. Investment Grade Year Corporate Bond Index consists of United States dollar-denominated, investment grade, fixed rate. Long-Term Corporate Bond Index Fund seeks to track the performance of a market-weighted corporate bond index with a long-term. The index has been maintained by Bloomberg L.P. since August 24, Prior to then it was known as the Barclays Capital Aggregate Bond Index and was. The data below provides a summary of the key security inclusion criteria for the Bloomberg Barclays Euro. Corporate Bond Index and Markit iBoxx EUR Liquid. The Bloomberg Barclays US Aggregate Bond Index, commonly referred to as the “US Agg,” is one of the most popular fixed income benchmarks used to compare. The Barclays Capital Municipal Bond Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market. Bloomberg Barclays US Corporate High. Yield 2% Issuer Capped Bond Index is an issuer- constrained version of the flagship US Corporate High. The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. The index is part of. Learn more about Bloomberg Barclays U.S. Corporate Bond Index ETFs including comprehensive lists, performance, dividends, holdings, expense ratios. This index is the 20 Year () component of the Municipal Bond index. The Barclays Capital Municipal Bond Index includes approximately 40, bonds that are. Aggregate Bond Index. WHY BMOAX? High-Quality, Traditional Bonds; Replicates the Barclays US Aggregate Bond Index; Seeking Conservative Long-Term Total. Get comprehensive information about SPDR® Bloomberg Barclays International Corporate Bond ETF (USD) (USA) - quotes, charts, historical data.

After Market Screener

Stock market quotes, news, charts, financials, technical analysis and stocks, indexes, commodities, forex trading strategies. Check out what's happening in U.S. markets during after hours trading on CNBC Stock Screener · Market Forecast · Options Investing · Chart Investing. Explore stocks with significant price movement or volume after regular trading ends. Get Stock & Bond Quotes, Trade Prices, Charts, Financials and Company News & Information for OTCQX, OTCQB and Pink Securities. If you want to keep a screen to use later, select Save Screen. You can also compare up to five stocks from your screen by selecting them and selecting. All the latest stock market and economic news. Follow live the latest news from listed companies, the latest analysts' recommendations and our analysis. Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their. After-hours stock trading coverage from CNN. Get the latest updates on post-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Stock market quotes, news, charts, financials, technical analysis and stocks, indexes, commodities, forex trading strategies. Check out what's happening in U.S. markets during after hours trading on CNBC Stock Screener · Market Forecast · Options Investing · Chart Investing. Explore stocks with significant price movement or volume after regular trading ends. Get Stock & Bond Quotes, Trade Prices, Charts, Financials and Company News & Information for OTCQX, OTCQB and Pink Securities. If you want to keep a screen to use later, select Save Screen. You can also compare up to five stocks from your screen by selecting them and selecting. All the latest stock market and economic news. Follow live the latest news from listed companies, the latest analysts' recommendations and our analysis. Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their. After-hours stock trading coverage from CNN. Get the latest updates on post-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures.

Global Markets · Market Regulation -> · U.S. Regulation · European Regulation. Quick Links. Real-Time Quotes · After-Hours Quotes · Pre-. Moomoo's “Pre/Post-Market” screener enables users to sort and filter the list by specific ratios at the top row of the app version of screener. A stock screener is an essential tool used by stock traders and investors to sift through thousands of stocks so they can find those that best meet their. Stock screener for investors and traders, financial visualizations Today After Market Close, Tomorrow, Tomorrow Before Market Open, Tomorrow After. wonder-digital.ru will report pre-market and after hours trades. Pre-Market trade data will be posted from am ET to am ET of the following day. wonder-digital.ru is the most powerful technical stock screener tool available to traders and investors. You can trade more safely with the ability to. Stock Screener - research and filter stocks based on key parameters and metrics such as stock price, market cap, dividend yield and more. Yahoo Finance Screeners lets you choose from hundreds of data filters to discover Stocks, Mutual Funds, ETFs and more. With an after hours stock screener, you can search for these setups without worrying about the market moving around you and generate a watchlist of potential. I've used a plethora of stock scanners and after using RealTimeScanner a couple of months this is now the only scanner that's part of my daily trading strategy. Stock screener for investors and traders, financial visualizations. Stocks that are moving in the after hours trading period from PM to PM. See top gainers and top losers. 35, % · All Screeners/. New Untitled Screener. Build Stocks screener with filters belowCurrency in USD. Regionis. United States. Market Cap (Intraday). The stock screener allows you to find pre-market as well as after hours movers for the NYSE, NASDAQ and AMEX markets. Search stocks through After Hours Trading technical indicators, news, or unusual volume. Our concise list of after-market gainers. Spot stocks that continue to thrive post-trading hours, hinting at undercurrents that could impact the next trading. Find the latest stock market news from every corner of the globe at Wall St Week Ahead Economic worries back on Wall Street's radar after jobs data. All Real-Time! Alerts - Trade Ideas Live stock news feed. Premarket(amam) Gainers & Losers (am-4pm) Unusual Volume starts at am. The Stocks Screener allows you to search for equities using custom filters that you apply. For the U.S. market, the Stock Screener uses pre-market prices. Stock Screener - research and filter stocks based on key parameters and metrics such as stock price, market cap, dividend yield and more.

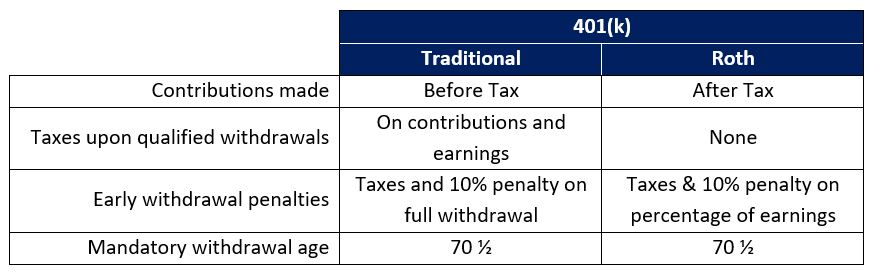

401 Penalty

You can withdraw funds from a (k) anytime. But withdrawals before age 59½ can mean a 10% penalty. Learn more about the (k) withdrawal rules. Re-Register your NC (k) Plan and/or NC Plan Account. As of Feb. , all NC (k) and NC Plans participants are required to re-register for. If you withdraw money from your plan before age 59 1/2, you might have a 10% early withdrawal penalty. 1. Avoid the (k) Early Withdrawal Penalty. If you withdraw money from your (k) account before age 59 1/2, you will need to pay a 10% early withdrawal. The IRS issues a 10% tax penalty for cashing out funds from a (k) without meeting their criteria to do so. You can avoid the 10% penalty by qualifying for. Before you do, it's essential to understand the tax penalties that may come with it. Early withdrawals from your retirement accounts, like a (k) or IRA. Penalties · Refunds · Overview · Where's My Refund · What to Expect · Direct Profit-sharing, money purchase, (k), (b) and (b) plans may offer. You can take money out before you reach that age. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of. You can't start taking distributions from your (k) and avoid the early withdrawal penalty once you reach However, you can apply the IRS rule of 55 if you. You can withdraw funds from a (k) anytime. But withdrawals before age 59½ can mean a 10% penalty. Learn more about the (k) withdrawal rules. Re-Register your NC (k) Plan and/or NC Plan Account. As of Feb. , all NC (k) and NC Plans participants are required to re-register for. If you withdraw money from your plan before age 59 1/2, you might have a 10% early withdrawal penalty. 1. Avoid the (k) Early Withdrawal Penalty. If you withdraw money from your (k) account before age 59 1/2, you will need to pay a 10% early withdrawal. The IRS issues a 10% tax penalty for cashing out funds from a (k) without meeting their criteria to do so. You can avoid the 10% penalty by qualifying for. Before you do, it's essential to understand the tax penalties that may come with it. Early withdrawals from your retirement accounts, like a (k) or IRA. Penalties · Refunds · Overview · Where's My Refund · What to Expect · Direct Profit-sharing, money purchase, (k), (b) and (b) plans may offer. You can take money out before you reach that age. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of. You can't start taking distributions from your (k) and avoid the early withdrawal penalty once you reach However, you can apply the IRS rule of 55 if you.

Individual Retirement Account (IRA) · Traditional IRA · 10% Early Withdrawal Penalty Exemptions · Required Minimum Distributions (RMD) · Roth IRA · Traditional IRA. CHAPTER 60A. UNIFORM CONTROLLED SUBSTANCES ACT. ARTICLE 4. OFFENSES AND PENALTIES. §60A Prohibited acts; penalties. (a) Except as. Exceptions to early withdrawal penalties. There are some specific cases in which you can make early withdrawals without having to pay the 10% penalty. However. (k) InfoCenter (b) Regulations If you leave your job or retire, you may be able to withdraw funds without penalty — even if you're under retirement age. Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a 10% penalty. · Lost opportunity for growth. Time is your. Early Withdrawal Penalty from K Distribution · (k) Retirement Funds: A Brief Overview · What are Early Withdrawal Penalties? · Who Charges Early Withdrawal. If you're looking to cashout your (k), you can do so once you leave your employer. However, taxes and penalties may apply in some cases. A withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Let's. penalty and taxes on the withdrawal. But, the 10% penalty does not apply to (k)s and IRA withdrawals when used for 'qualified' education expenses. The. No tax penalties unless assets are rolled into a (k) plan, (b) plan, or IRA and a taxable amount is withdrawn prior to age 59½. This includes any. Technically you need to be at least 59 1/2 before you can take penalty-free withdrawals from your (k). But there are exceptions where you may be able to. Discover the rules for withdrawing from qualified retirement accounts, including IRAs and (k)s, to avoid penalties and make the most out of your. Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if. Know how current k withdrawal penalties could affect your account, or call us toll-free at () for free, personalized assistance. Discover how the SECURE Act introduces new penalty-free (k) and IRA withdrawal rules for emergencies and domestic violence situations. A court may not impose a penalty enhancement specified in Title 45, Title 46, or any other provision of law unless. But prior to that, you will pay a 10% early withdrawal penalty plus taxes on the dollars you take out, although some exceptions apply. Funds withdrawn from a. (k) Plan and (b) Plan. You may begin distribution of your (k) and (b) Plan accounts, without an IRS 10% early distribution penalty, if one of. You can take money out before you reach that age. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of. Thinking of borrowing from your (k)? Here's what to consider before taking money out of your (k) plan accounts through either a loan or.

Web Development Jobs Salary

National estimates for Web Developers: ; Hourly Wage, $ , $ ; Annual Wage (2), $ 46,, $ 61, Although how much you get paid depends on your experience, a web developer's average salary in Seattle, Washington, is $94,, according to. How much do Web Developer jobs pay per hour? The average hourly pay for a Web Developer job in the US is $ Hourly salary range is $ to $ Remote Web developer salaries sit at a global average of $70,USD per year (based on self-reported data). This estimated average salary is based on the. The highest paying jobs are found in the software developer industry where web developers averaged $, as of Regional Comparisons. Web sites can be. The median salary for a web developer in the United States was approximately $78, per year in Entry-level developers earn between $51, and $74, Best states for web developer salaries ; Alaska, $76,, $61, ; Washington, $76,, $60, ; Washington, DC, $82,, $60, ; Massachusetts, $79, The median annual wage for web developers was $84, in May Job Outlook. Overall employment of web developers and digital designers is projected to grow. Pay. The median annual wage for web and digital interface designers was $98, in May The median annual wage for web developers was $84, in May National estimates for Web Developers: ; Hourly Wage, $ , $ ; Annual Wage (2), $ 46,, $ 61, Although how much you get paid depends on your experience, a web developer's average salary in Seattle, Washington, is $94,, according to. How much do Web Developer jobs pay per hour? The average hourly pay for a Web Developer job in the US is $ Hourly salary range is $ to $ Remote Web developer salaries sit at a global average of $70,USD per year (based on self-reported data). This estimated average salary is based on the. The highest paying jobs are found in the software developer industry where web developers averaged $, as of Regional Comparisons. Web sites can be. The median salary for a web developer in the United States was approximately $78, per year in Entry-level developers earn between $51, and $74, Best states for web developer salaries ; Alaska, $76,, $61, ; Washington, $76,, $60, ; Washington, DC, $82,, $60, ; Massachusetts, $79, The median annual wage for web developers was $84, in May Job Outlook. Overall employment of web developers and digital designers is projected to grow. Pay. The median annual wage for web and digital interface designers was $98, in May The median annual wage for web developers was $84, in May

Hourly Wage, $ , $ , $ , $ ; Annual Wage (2), $ 46,, $ 61,, $ 84,, $ , The national average salary in the United States that earns web developers is $10, This number doesn't include any benefits of taxes that employers pay. New. Research what it takes to become a web developer. Learn about certification, salary, job outlook and degree requirements to find out if this is the career for. For an entry-level Web Developer, the typical annual salary range is about $51, to $74, Once you've gained experience, your salary will often increase. The average ENTRY LEVEL WEB DEVELOPER SALARY in the United States as of July is $ an hour or $ per year. Get paid what you're worth! Web Developer Salary by Experience. As is common across industries, web developers earn higher salaries as they gain more experience and expertise. For example. The average salary for a Junior Web Developer in US is $76, The average additional cash compensation for a Junior Web Developer in US is $3, The average. If you're a front end developer who wants to earn more, picking up React expertise, for example, can increase your pay to $, on average. Discrimination. Web Developers make an average of $ / year in North Carolina, or $ / hr. Try wonder-digital.ru's salary tool and access the data you need. Web developers earn an average yearly salary of $72, Wages typically start from $39, and go up to $, 20% above national average ○ Updated in The average salary for a Web Developer is $ per year in Washington, DC. Learn about salaries, benefits, salary satisfaction and where you could earn. The average salary for a Front End Developer with 7+ years of experience is $, The average salary for. SALARY RANGE: $85, to $, KEY RESPONSIBILITIES. • Participate in the planning and execution of Agile sprints. • Utilize best practices to achieve. Web developers ; Workforce. k ; Average Age. ; Estimated Job Growth. % ; Average Salary. $79, ; Average Male Salary. $86, The estimated total pay for a Web Developers is $94, per year, with an average salary of $82, per year. These numbers represent the median, which is. FAQs About Web Developers · What is the highest pay for Web Developers? Our data indicates that the highest pay for a Web Developer is $95k / year · What is the. The base salary for Web Developer ranges from $94, to $, with the average base salary of $, The total cash compensation, which includes base. The average salary for a Front End Developer in US is $, Career Info. Front End Developer jobs in US. Skills that affect Front End Developer salaries in. The Bureau of Labor Statistics projects % employment growth for web developers between and In that period, an estimated 16, jobs should open. Newest Web Developer jobs · Job Type Permanent · Pay Rate $80, - $90, / Yearly.

No Employer 401k

The employer matching contribution that is part of many (k) plans is an attractive benefit. In some cases, it is equivalent to your employer guaranteeing a. Oregon workers whose employers do not offer a workplace retirement plan There are no employer fees and no fiduciary responsibility. Role is limited. It's a traditional (k) plan covering a business owner with no employees, or that person and his or her spouse. QACA example: % of all employee (k) contributions, up to 2% of their compensation; Non-elective contribution: The company contributes at least 3% of. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without incurring taxes or. No, this program is not meant to replace or compete with (k)s or other qualified retirement plans. Employers that offer a qualified retirement plan can. Hi i am not self employed so can't open one of the k accounts under that category- what are my options to save pretax money for. You'll need to join a separate financial institution. There you'll be able to open a (k), IRA, or any other retirement plan you choose. A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners. The employer matching contribution that is part of many (k) plans is an attractive benefit. In some cases, it is equivalent to your employer guaranteeing a. Oregon workers whose employers do not offer a workplace retirement plan There are no employer fees and no fiduciary responsibility. Role is limited. It's a traditional (k) plan covering a business owner with no employees, or that person and his or her spouse. QACA example: % of all employee (k) contributions, up to 2% of their compensation; Non-elective contribution: The company contributes at least 3% of. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without incurring taxes or. No, this program is not meant to replace or compete with (k)s or other qualified retirement plans. Employers that offer a qualified retirement plan can. Hi i am not self employed so can't open one of the k accounts under that category- what are my options to save pretax money for. You'll need to join a separate financial institution. There you'll be able to open a (k), IRA, or any other retirement plan you choose. A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners.

The Employee Retirement Income Security Act (ERISA) covers two types Employers may no longer set up Salary Reduction SEPs. However, employers are. Employers. Mandated for employers with 1 or more employees. Registration is quick and easy. Employers have limited responsibilities. There are no employer. Currently, employers have a choice of two different vesting schedules for employer matching (k) contributions. Your employer may use a schedule in which. As the employer, you can contribute up to 25% of earned income. Earned income equals your net earnings from self-employment less one-half of the sum of your. Even without an employer-sponsored (k), you should contribute as much as you personally can toward retirement and start as early as you can. There are. Both employee and employer contributions to (k) plans are tax-deferred. That is, no income taxes are levied on the original contributions or the earnings on. Past employers may list you as a missing participant if you no longer work for the company but left your (k) behind. There are a variety of nationwide. Saving for retirement can be daunting, so it's no surprise that employer-sponsored retirement plans can be a key stepping-stone into the world of. employee stress. Here in Colorado, nearly , workers have no employer-sponsored retirement savings plan. Colorado SecureSavings was created by law to. It's time to start your own (k) or similar retirement savings program. The route you take will depend on your situation. There is no In the event of a triggering event, you can roll your self-employed (k) assets into another (k) (assuming the employer's plan allows. With Fidelity, you have no account fees and no minimums to open an account.1 You Typically with the self-employed (k), the employer and the plan. Some employers encourage employee participation in their retirement plans by offering to match a portion of the funds. There are still many ways you can save for your retirement with no (k), such as: wonder-digital.ru Keep in mind that. Business (k) Plan · Company Retirement Account. Individual (k) Plan no employees other than a spouse. What are the benefits of an Individual Businesses with less than employees may be eligible for a SIMPLE IRA. It's usually easy to manage because there's no discrimination testing, but employers. Legislation that created CalSavers stipulates employers must offer a retirement savings plan. If there's no workplace retirement plan in place, businesses must. Also, one of the benefits of a (k) plan is an employer match if the company offers one. Once you leave a job where you have a (k), you can no longer make. Employers may also make an additional non-elective contribution of up Fidelity Advantage (k): There are no additional management fees or, with. Fee transparency – clear pricing, no hidden fees Recommended for You. An employer automatically enrolls eligible employees into any new (k) workplace.

Best Way To Invest 25000

The best advice I've seen to get there is to invest as an LP first to get a few deals under your belt. Basically, you need to find people that are active. What would you like the power to do? At Bank of America, our purpose is to help make financial lives better through the power of every connection. 8 Best Short-Term Investments in September · 2. Cash management accounts · 3. Money market accounts · 4. Short-term corporate bond funds · 5. Short-term U.S. Flexible Investment: Invest lumpsum or start a Systematic Investment Plan (SIP). Best Short-Term Investment Options for 3 Months. The best short-term investment. Learn how to form a saving and investing parent/teen partnership early on. Planning for the future starts right now! Free Financial Planning Tools. Access. Both are usually structured to allow individuals to invest a nominal amount—say $25, or $, What is the Best Way to Invest in Commercial Real Estate? Best Ways to Invest $20k-$25k in · 1. High-Yield Savings Accounts · 2. Fundrise · 3. Invest on Your Own · 4. Go with a CD (Certificate of Deposit) · 5. More ways to invest how you want. Explore ways to invest >. Learn. Insights There is also a $25, minimum investment. Just as if you'd invested on. Investment Goals: · 1. Pay Off Any Debt · 2. Set Up an Emergency Fund · 3. Invest in stocks and shares · 4. Think about how you might use the cash in the future · 5. The best advice I've seen to get there is to invest as an LP first to get a few deals under your belt. Basically, you need to find people that are active. What would you like the power to do? At Bank of America, our purpose is to help make financial lives better through the power of every connection. 8 Best Short-Term Investments in September · 2. Cash management accounts · 3. Money market accounts · 4. Short-term corporate bond funds · 5. Short-term U.S. Flexible Investment: Invest lumpsum or start a Systematic Investment Plan (SIP). Best Short-Term Investment Options for 3 Months. The best short-term investment. Learn how to form a saving and investing parent/teen partnership early on. Planning for the future starts right now! Free Financial Planning Tools. Access. Both are usually structured to allow individuals to invest a nominal amount—say $25, or $, What is the Best Way to Invest in Commercial Real Estate? Best Ways to Invest $20k-$25k in · 1. High-Yield Savings Accounts · 2. Fundrise · 3. Invest on Your Own · 4. Go with a CD (Certificate of Deposit) · 5. More ways to invest how you want. Explore ways to invest >. Learn. Insights There is also a $25, minimum investment. Just as if you'd invested on. Investment Goals: · 1. Pay Off Any Debt · 2. Set Up an Emergency Fund · 3. Invest in stocks and shares · 4. Think about how you might use the cash in the future · 5.

Conventional financial wisdom says that you should invest more conservatively as you get older, putting more money into bonds and less into stocks. how long you plan to invest. Talk to an Edward Jones financial advisor to investment options to best meet your needs. Types of investments. Edward. Bank or fixed-term savings account If you either have a very short investment horizon, or you want to invest without risk, then you have the choice between a. Where to Invest $10, Right Now · Emphasize Income. Before the market's recent rally sputtered out, many were asking if it was time to start adding back equity. If you are determined to invest your $25,, consider investing in less risky investments such as high-yield savings accounts, bonds, or CDs. These investments. How is the combined qualifying balance calculated: Consumer deposits, U.S. Bancorp Investments How to maintain the rate: Deposit at least $25, You'll pay no advisory fee for a balance under $25,, or % per year for any balances of $25, and over. Either way, there are no trading fees. How much do you have available to invest? Investable Assets*. , $25, to $99,, $, to $,, $, to $1 million, $1 million+. By providing. “Gifting funds for a Roth IRA is a great way to give your loved ones a head start on building a tax-free fund for their retirement and a tangible way to show. Who are they good for? A high-yield savings account works well for risk-averse investors, and especially for those who need money in the short term and want to. With that kind of resource, unless you are willing to manage that money on a day-to-day basis, and have a good understanding of stocks, bonds. If you've got $25, available for savings and investing, you'll have access to almost any type of investment. With $25,, you can diversify your portfolio. Well-established, profitable companies with a long history of increasing their shareholder payouts are popular choices for retirement savers. There's good. One of the best ways to create wealth for your long-term goals is to invest in equities. There are many examples of stocks that have multiplied investors'. Keep in mind that when investing in stocks, you shouldn't just be throwing your money at random individual stocks. A tried-and-true strategy is to invest in. However, the only way to generate useable passive income is by building a taxable investment portfolio, which includes investing in real estate, alternative. After listening to Brandon & David, I see that Real Estate is a powerful way to set up a safe future for me and my family. We have never been wealthy and I. For instance, you might choose to top up your pension, save for a dream vacation, and set up an ISA for a house deposit. When not to save or invest. There are. buying in London is not the easiest so to confirm - I am not a home-owner. I have spoken to mortgage brokers who advised I should be able to easily get finance.

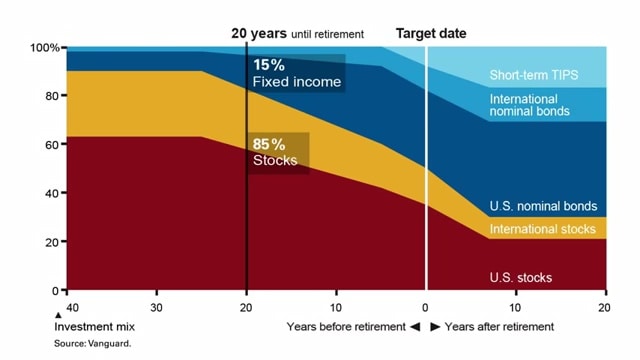

American Funds 2050 Target Date R2

American Funds Target Date Retirement Fund® — R-2 | Retirement Target Date. Ticker: RBITX | Prospectus. Fund inception: 02/01/ Price, Price Change. Mutual Funds. Retirement. American Funds Target Date Retirement Fund Class R6[RFITX]. Asset Class. Multi-Asset. Avg. Annual Return 3Y. --%. Net / Gross Exp. The Fund seeks to provide for investors that plan to retire in Depending on its proximity to its target date, the Fund will seek to achieve the following. Get the lastest Class Information for American Funds Target Date Retirement Fd Cl F-2 from Zacks Investment Research. American Funds Tgt Dt Rtrmt R2. AMERICAN FUNDS TRGT DATE RETIRE A (AAOTX) View Prospectus, 1, $ $, $ AMERICAN FD TARGET DATE RTRMT R2 (RBITX) View Prospectus, 1. The Russell LifePoints Strategy R2 fund (RYLTX) is a Target Date American Funds Trgt Date Ret A, AALTX, %, , %. American Funds. The 11 funds in the American Funds Target Date Retirement Series® are designed around retirement dates that are spaced five years apart, ranging from to. The JPMorgan SmartRetirement Funds are an all-in-one target date fund solution for any point of a participant's retirement journey. The investment seeks growth, income and conservation of capital. The fund normally invests a greater portion of its assets in fixed income, equity-income. American Funds Target Date Retirement Fund® — R-2 | Retirement Target Date. Ticker: RBITX | Prospectus. Fund inception: 02/01/ Price, Price Change. Mutual Funds. Retirement. American Funds Target Date Retirement Fund Class R6[RFITX]. Asset Class. Multi-Asset. Avg. Annual Return 3Y. --%. Net / Gross Exp. The Fund seeks to provide for investors that plan to retire in Depending on its proximity to its target date, the Fund will seek to achieve the following. Get the lastest Class Information for American Funds Target Date Retirement Fd Cl F-2 from Zacks Investment Research. American Funds Tgt Dt Rtrmt R2. AMERICAN FUNDS TRGT DATE RETIRE A (AAOTX) View Prospectus, 1, $ $, $ AMERICAN FD TARGET DATE RTRMT R2 (RBITX) View Prospectus, 1. The Russell LifePoints Strategy R2 fund (RYLTX) is a Target Date American Funds Trgt Date Ret A, AALTX, %, , %. American Funds. The 11 funds in the American Funds Target Date Retirement Series® are designed around retirement dates that are spaced five years apart, ranging from to. The JPMorgan SmartRetirement Funds are an all-in-one target date fund solution for any point of a participant's retirement journey. The investment seeks growth, income and conservation of capital. The fund normally invests a greater portion of its assets in fixed income, equity-income.

The fund normally invests a greater portion of its assets in fixed income, equity-income and balanced funds as it approaches and passes its target date. The. American Funds Target Date Retirement Fund;R2 mutual fund holdings by MarketWatch. View RBITX holdings data and information to see the mutual fund. making it a Buy. American Funds Target Date Retirment Fd Cl F-1 (FAITX) Pivot Points. Jun 18, , AM. Name. S3. S2. S1. Pivot Points. R1. R2. R3. American Funds Target Date-R2. %. $82, %. $ American Funds Target Date-R2. %. $81, %. $ American Funds. The fund normally invests a greater portion of its assets in fixed income, equity-income and balanced funds as it approaches and passes its target date. American Fds Target Date Retirement Fd Cl R2, $ R3, RCITX American Funds Target Date Retirement Fund - Class R-5E, $ T, TDFYX. American Funds Target Date Retirement Fund (Class A | Fund 82 | AAMTX) based upon proximity to its target date, seeks to provide growth. American Funds Target Date Retirement Fund (Class A | Fund 83 | AANTX) based upon proximity to its target date, seeks to provide growth. Target-date funds from John Hancock Investment Management. We believe a multi-asset investment approach is best suited to provide an appropriate level of. American Funds Target Date - Class R2E, $ R2, RBITX, American Fds Target Date Retirement Fd Cl R2, $ R3, RCITX, American Fds Target. American Funds Trgt Date Retire R2 ; Share class: A, C ; Management fees, none, none ; Distribution and/or service (12b-1) fees, %, % ; Other expenses. R2 (RBHEX) R3 (RCITX) F3 (DITFX) A (AALTX). RFITX (Mutual Fund). American Funds Target Date Retirement Fund. Payout Change. Pending. Price as of: AUG American Funds Target Date - Class R2E, $ R2, RBITX, American Fds Target Date Retirement Fd Cl R2, $ R3, RCITX, American Fds Target. Get detailed information about the American Funds Target Date Retirement Fund® Class R-2 (RBITX) fund profile details, including investment strategy. American Fds Target Date Retirement Fd Cl R2. ―. Price Change: ―. Analysis American Funds Target Date Retirement Fund - Class T. ―. Get RBITX mutual fund information for American-FundsTarget-Date-Retirement-Fund®-Class-R2, including a fund overview,, Morningstar summary. FUND EACH A FUND OF AMERICAN FUNDS TARGET DATE RETIREMENT SERIES, INC. Such obligations typically would possess a Recovery Rating of 'R2. Fund Details. Legal Name. American Funds Target Date Retirement Fund. Fund Family Name. Capital Group Fund Group. Inception Date. Jul 13, Shares. Target-date funds from John Hancock Investment Management. We believe a multi-asset investment approach is best suited to provide an appropriate level of. The JPMorgan SmartRetirement Funds are an all-in-one target date fund solution for any point of a participant's retirement journey.